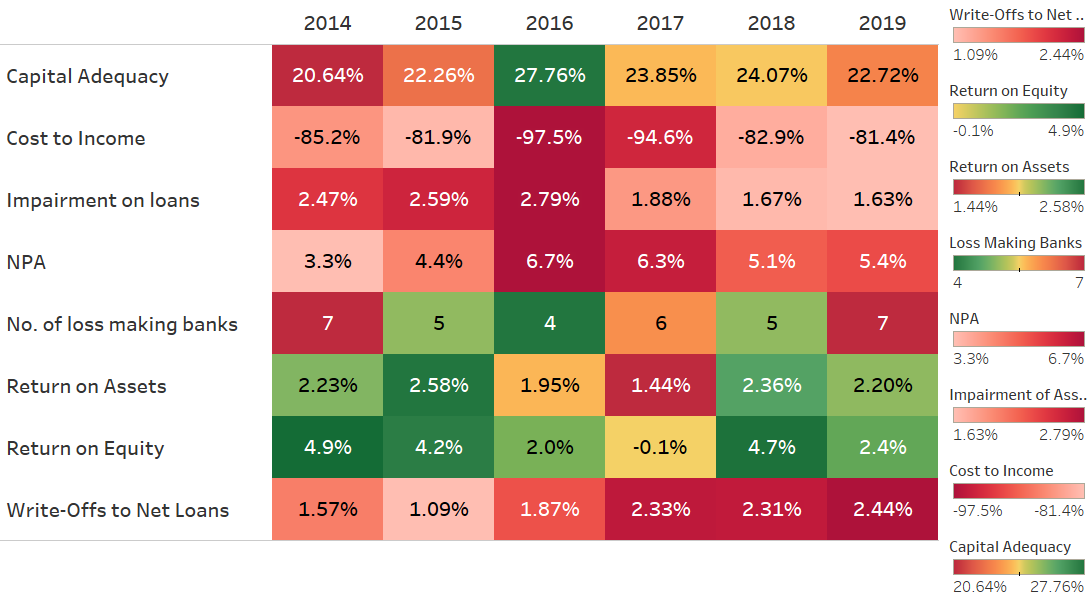

While Uganda’s financial sector grew in size with assets growing by more than 14.3%, the sector performance declined significantly with more financial institutions reported as undercapitalized, lower asset quality, increased number of loss-making banks, and lower return on investment.

Below are a few sector highlights:

- There was a new entrant in the banking sector, Afriland First Bank from Cameroon, the bank that believes in creating a lasting impact on customers, through a pact, one client at a time.

- Capital Adequacy dropped significantly

Capital Adequacy measures the solvency of the banks. Basel III Guidelines recommend a capital adequacy ratio of not less than 10.5% and a core capital to risk-weighted assets of 6.5% for a financial institution to remain capitalized and avoid going insolvent. Core capital comprises retained earnings and other preferred stock. While risk-weighted assets are weighted based on their risk, that is loans with high risk like unsecured loans are given a weight of 100% while treasury bills that are considered risk free are given a weight of 0%. There were more undercapitalized banks in 2019, including Orient, CBA, Tropical Bank, and KCB compared to only 3 in 2018.

- Few banks had lower asset quality with non-performing loans increasing from 5.1% of total loans to 5.4% as the sectors became highly delinquent. There was overall worse credit management in the entire sector in 2019.

- Seven banks reported operating losses compared to only 5 in 2018. This was attributed to high impairment charges especially banks like Tropical Bank, Orient, and Top Finance Bank while Cairo suffered due to increased personnel costs.

- The banks gave investors a lower rate of return on their investment dropping from 4.7% in 2018 to 2.4% in 2019. This was due to lower profitability due to high costs of doing banking in several financial institutions that led to losses

- Industrial cost to income dropped to 81.4% with better efficiency in most banks on the management of costs and an overall better impairment charge falling from 1.67% in 2018 to 1.63% in 2019.

Copyright Summit Consulting Ltd, 2020. All rights reserved.