Download a copy of this article: My-take-on-the-proposal-to-require-NSSF-to-pay-20-to-members.pdf (179 downloads )

On 12th May 2020, I received a rare call from one of the bank executives. He wanted to ‘pick my mind’ about the NSSF’s briefing to the Minister of Finance, Planning and Economic Development over the implications of the proposal to require NSSF to pay 20% to members. According to NSSF, the proposal has implications that could distress the NSSF as a retirement scheme and the economy.

My take is NSSF should pay highly affected members first, gradually pay other members. Below, I show how this is possible. The objective of saving is to have something to fall back to when trouble knocks. #covid19 is the trouble. Social saving should not be interpreted as literary to mean old age. And Uganda’s economy is not very small that Ugx. 2.6 trillion would disorganize it.

For a brief review of the NSSF paper, see section two of this article. First, insights and recommendations. To understand this analysis better, read Table 1, and Figure 1 after reading the NSSF briefing which you can download here.

Section 1, insights, and recommendations

- In the NSSF briefing, an assumption has been made that the Fund is currently at Zero Deposit on cash and bank balances as well as on deposits with commercial banks. In this analysis, we assume the Fund has only enough cash for its day-to-day operations, and that there are no assets nearing maturity within the next 6 months. Such assumptions by the Fund managers make the 20% proposed payout appear problematic.

Table 1: NSSF briefing analysis

-

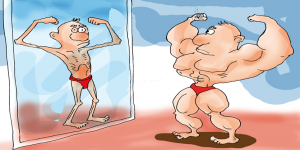

As you can see in Figure 1, the members who make up 88.9% of NSSF membership control just 8% of the Fund Value. These are the people most affected by the COVID19 and hold just Ugx. 1 Trillion. A payout of 20% of their savings to them would not affect the economy and the Fund. On the contrary, such a move would stimulate effective demand, especially for agricultural products since the biggest expense is food, which is produced locally. The Ugandan farmers would be happy. The affected members would be happy too. And the economy would benefit due to the increased consumption of local products.

Figure 1: Composition of NSSF membership & funds held.

- Liquidity. Indeed, the projected cash outflow of Ugx 2.5 trillion is quite huge. But that is when the pay-out is generalized. Not all members need the money now! Ok, not all members should be paid out. Talking about liquidity, almost half of the said Ugx. 2.5 trillion could be paid through return on earnings like dividends received, interest earned from bonds, and rental income to be made in the FY 2020/21. However, let us assume the Fund projects a loss this year from all investments due to the #covid19 pandemic.

Table 2: NSSF pay-out strategy to most at-risk members

- The key question to ask ourselves is what period shall the cash outflow be paid? If it is one year, and you make a blanket payment to all members, then the argument could be correct. However, if priority is given to most at risk savers, and payment is spread say over 0 (FY2020/21) to 4 (FY2024/25) years paid depending on the impact of the pandemic on the NSSF members, then liquidity would not be a problem as the Fund has time to retire mature bonds. Highly affected members should get paid first with the rest of the members getting their benefits by the fourth or fifth year or even not getting at all! See Table 2, lines 13, 15, 16, and 17. Must NSSF pay a uniform % to all members? Maybe not. As you can see above, since this is an emergency, all payout cash flows are timed in year 0, FY2020/21.

- For effective payout, NSSF should categorize members and offer different percentages depending on members’ balances with the Fund (Table 2) i.e. members with balances Ugx. 10 million and below could access 20%, those with more than Ugx. 10m but less than Ugx. 50m to access 10%, and those with above Ugx. 100m are well off already and may not need access to the money. The fact is if someone has a balance of more than Ugx. 90m with the Fund, they already earn big salaries and they are not badly affected, or they have opted to keep their money there in which case they are not affected by this proposal. It is the folks with small balances that badly need their savings.

- Table 2 shows this proposal has an overall additional impact of 4.09% of the current Fund value! In case the super savers need payment, the Fund could plan to accommodate the cash flows by making payment in 3-5 years to reduce the liquidity impact on the Fund. The current Fund payout commitment of Ugx. 800billion plus additional Ugx. 532 billion payment (see Table 2, after line 17). That gives Ugx. 1.332 trillion, which the Fund can easily accommodate without prematurely retiring any investments.

- On the membership of NSSF, it was highlighted in the briefing that only 7% of the active members have balances of Ugx. 50 million and above and hence this will not have a significant impact on the economy. I have another perspective on this argument. Many of the NSSF members have extended families and of course, many of their relatives will be affected by the pandemic. The 7% members of the active members must support their extended families like as been the case over time. The key issue is that NSSF’s core objective is to ensure the social security of its members, the response highlighted by NSSF makes a member wonder whether members own NSSF or it is owned by other external stakeholders or investors! Whereas it is important to be cautious and support the economy and private sector, it is important to remain loyal to members, especially in times of need. NSSF needs to live to the sole purpose test of its existence to its members. And now is the time to make the call.

- In my view, all the other issues raised by NSSF apart from NSSF Member metrics are dependent on liquidity. Once this is sorted, then all the others will be sorted. As I have shown above (Table 2), if payments are spread out, the liquidity argument in the briefing no longer holds.

- Key Proposed Recommendations

- NSSF should consider staggering payment of 20% over 4 years with highly affected members receiving payment first and so on. This will ease liquidity. Not all members need the 20% pay-out since they are already doing fine. After all, what is the meaning of social savings?

- NSSF should consider payment of different percentages depending on member balances. These could range from 20% for members with small balances, and 5% or lower or none for members with higher balances. By the time they saved to such balances, those members are already doing fine…

- NSSF can come up with criteria to support only the highly affected members. This approach has been done in Australia. Up to 4 social security funds have received over 100,000 applications for their members suffering financial hardship from #Covid19 pandemic.

- NSSF should consider borrowing from other stakeholders/ or other sources at a fee to support its temporary liquidity obligations. NSSF must put their members’ interests first, and foremost and not those of other stakeholders.

- NSSF should stop working to defend the interests of a few members. The projects which NSSF is investing in are way out of reach by most of her members who make up 88.9% of the Fund, but just 8% of its total value! For example, in Lubowa the cheapest apartment goes for US$ 150,000. How do the members benefit from such projects considering that the average savings by each member are just Ugx 1,500,000! This is unfair and unfortunate. Of course, the argument could be the Lubowa houses are not meant for the Fund members, but rather to make the Fund grow. But surely, why would a parent make lots of money but fail to have avail some for their children to go to school? Since the majority of the Fund members are folks with low means, why not invest in projects that offer them affordable housing?

Figure 2: NSSF membership composition.

- What do you think? Is NSSF justified to deny a 20% payout to the most vulnerable members who make up 88% of the Fund membership, but just 8% of its value? What would happen to the economy if the Fund decided to pay them their 100%, over the next 2 years?

Section 2, the NSSF letter in summary

According to NSSF, paying 20% to members hurts the economy in the following ways:

- Liquidity – a 20% payout to members represents Ugx. 2.6 trillion, given the Fund’s current value at approximate Ugx. 13 trillion. Add the planned payout of normal benefits to current qualifying members in the FY 2020/21 at Ugx. 800 billion, means a total of Ugx. 3.4 trillion cash out, if the 20% proposal is approved.

- To finance the Ugx. 3.4 trillion, the Fund would have to sell assets to raise the money. Considering NSSF is the biggest buyer of the Government of Uganda bonds (holds over 50%). GOU would struggle to find buyers in the secondary market if NSSF was a net seller of bonds. The proposal would also halt the current projects by NSSF – Government Campus (Ugx 853 billion), Pension Towers (Ugx. 307 billion), Lubowa Housing Estate (Ugx. 250 billion), Temangalo Housing Project (Ugx. 103 billion, Yusuf Lule Road (Ugx. 160billion) and Off taker, project (Ugx. 23 billion).

- The proposal could lead to higher adjustments of the interest rates on existing loans leading to a high risk of non-performing assets thus affecting the private sector, capital markets, and the entire economy. This is because high interest in government securities would cause banks to limit private sector retail and corporate lending. Here is why: NSSF sales government bonds to get Ugx. 3.4 trillion in FY2020/21 –> must do so at lower interest rates to get customers (who would be banks mostly) –> banks must see the bonds attractive to invest their money –> they will stop lending to the private sector and put money in the now available government bonds –> crowding out the private sector. That is the NSSF argument. The same would apply to equities on the capital market NSSF holds valued at Ugx. 1.5 trillion.

- The Fund has 2.3 million members of which 1.2m are core, of which 53% are active – they make at least one contribution per year. And that 100,000 members or 8.3% of the core members own 75% of the Fund. And 1m active members (80%) have balances below Ugx. 10m and just 7% have balances greater than Ugx. 50m. To NSSF, the 20% payout proposal will not address the wider need for relief!

- And finally, the proposal has both financial and legal implications. NSSF currently classifies investments in bonds as held to maturity. The sale would change this classification, which could lead to possible losses. And in the recent ruling David Chandi Jamwa vs Uganda 2019, the Supreme Court dismissed Jamwa’s appeal for causing financial loss when he sold bonds on the secondary market at a loss before maturity. NSSF concludes that the covid19 pandemic has strengthened the existing plea by members for mid-term access to their savings. And that such a position needs to be agreed upon in the amendments of the NSSF act allowing for the introduction of new benefits relating to unemployment, medical, housing, and education. And funding of those additional benefits would call for a need for additional savings beyond the standard 15% contribution.

Click here to download the Letter-to-Hon.-Minister-Implications-of-the-Proposal-to-Pay-20-percent-to-Fund-Members.pdf (338 downloads )

Download a copy of this article: My-take-on-the-proposal-to-require-NSSF-to-pay-20-to-members.pdf (179 downloads )

Copyright Mustapha B Mugisa, 2020. All rights reserved.